Introduction

Understanding Retirement Planning

Retirement planning can often feel like navigating a maze. As people transition into their golden years, they frequently face uncertainty about their finances and future lifestyle. Many contemplate how to sustain their financial needs, whether from savings, Social Security, or other sources. For instance, retirees may find their income is insufficient, leading them to explore alternatives like reverse mortgages.

Importance of Financial Security

Achieving financial security is crucial for a comfortable and fulfilling retirement. Consider the following aspects:

- Stable Income Source: Reliable income can alleviate anxiety and allow retirees to focus on enjoyment and health rather than financial stress.

- Healthcare Costs: With rising healthcare costs, having a safety net is essential.

- Home Equity Utilization: Many seniors own homes with significant equity, which can be transformed into cash through financial instruments like reverse mortgages.

By understanding and planning for these factors, retirees can pave the way for a more secure and enjoyable retirement.

Exploring Reverse Mortgages

What is a Reverse Mortgage?

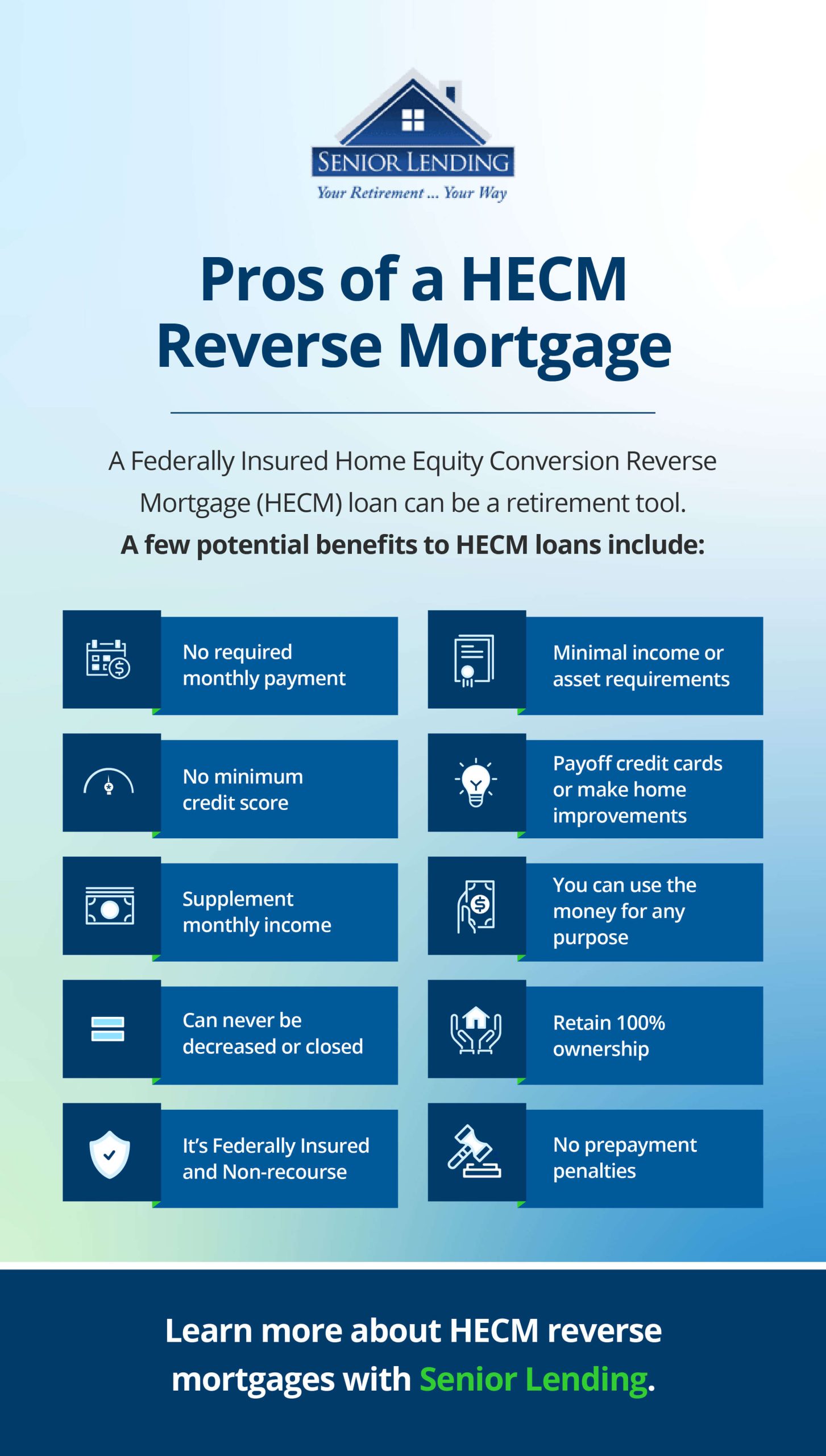

A reverse mortgage is a unique financial product designed specifically for senior homeowners aged 62 and older. It allows them to convert a portion of their home equity into cash, providing a lifeline for supplementing retirement income without the burden of monthly mortgage payments.

- Common Type: The Home Equity Conversion Mortgage (HECM) is the most prevalent type offered.

- Age Requirement: At least one borrower must be 62 or older.

- Continued Residence: Borrowers can remain in their homes throughout the loan term, provided they maintain their property taxes and insurance.

How Does It Work?

The functioning of a reverse mortgage hinges on several key principles.

- Equity Conversion: Homeowners can draw on their home equity, receiving funds as a lump sum, monthly payment, or line of credit.

- Deferring Payments: Unlike traditional loans, repayments are deferred until the homeowners move out, sell the house, or pass away.

- Loan Repayment: When the time comes to repay the loan, the home is typically sold, and any remaining equity is passed on to heirs.

For example, a retiree with a fixed income can use a reverse mortgage to ease financial pressures, allowing them to cover healthcare expenses or fund family visits without the stress of monthly bills.

Benefits of a Heartland Reverse Mortgage

Financial Flexibility

One of the standout benefits of a Heartland Reverse Mortgage is the financial flexibility it offers. Homeowners have the freedom to access their home’s equity in a way that best suits their needs.

- Customizable Disbursement Options: Borrowers can choose how they receive their funds – whether as a lump sum, monthly payments, or a line of credit.

- Unrestricted Use of Funds: You’re free to use the money for anything, from home renovations to medical expenses or even a dream vacation, allowing you to make decisions tailored to your situation.

This flexibility provides peace of mind during retirement, equipping seniors with the means to manage expenses with ease.

Supplementing Retirement Income

For many retirees, fixed incomes can pose challenges in maintaining a comfortable lifestyle. A Heartland Reverse Mortgage can act as a lifeline, offering:

- Supplementary Cash Flow: This financial tool can provide a steady stream of income, bridging the gap between retirement savings, Social Security, and daily living expenses.

- Improved Quality of Life: By supplementing retirement funds, homeowners can focus on enjoying their retirement years rather than stressing over finances.

In essence, a Heartland Reverse Mortgage not only enhances financial security but also empowers seniors to live their golden years to the fullest.

Qualifying for a Reverse Mortgage

Eligibility Criteria

To qualify for a reverse mortgage, borrowers must meet specific criteria designed to ensure they can effectively manage the financial commitment. Here are the key eligibility requirements:

- Age Requirement: At least one homeowner must be 62 years or older.

- Home Equity: Borrowers should have sufficient equity built up in their home.

- Primary Residence: The property must be the borrower’s primary residence.

- Financial Responsibility: Borrowers must remain current on property taxes, homeowner’s insurance, and maintenance obligations.

This means that meticulous financial planning is crucial, as these factors contribute significantly to the overall process.

Property Requirements

When it comes to the property, certain conditions must be met to qualify for a reverse mortgage. Consider these aspects:

- Property Type: The home must be a single-family residence, a one-to-four unit home, or an FHA-approved condo.

- Condition of the Home: The property must be in good condition, compliant with local building codes and regulations.

These requirements ensure that the property can sustain its value as collateral for the reverse mortgage, providing peace of mind for both borrowers and lenders alike.

Impact on Retirement Savings

Effect on Social Security

A reverse mortgage can influence Social Security benefits in several ways. For instance, since the funds received from a reverse mortgage are not classified as income, they do not directly affect the amount received from Social Security. However, seniors should be mindful of how withdrawing funds from a reverse mortgage might affect their overall financial strategy, especially if they are relying on Social Security as a primary income source.

- Non-Taxable Income: Funds from a reverse mortgage are tax-free, which means they don’t count as income for tax purposes.

- Supplemental Use: Many retirees utilize the proceeds to cover costs that might otherwise impact their Social Security, such as healthcare or daily living expenses.

Managing Estate Planning

Another consideration for seniors using reverse mortgages is estate planning. Since the loan needs to be repaid either when the borrower moves out, sells the home, or upon their passing, heirs may face a steeper obligation than anticipated. Here are a few key points to consider:

- Loan Repayment: The estate will need to repay the reverse mortgage balance, which could reduce the inheritance for heirs.

- Property Value Awareness: Knowing that the home might be worth less in the future can help in planning how to manage the estate and any potential taxes involved.

Navigating Social Security and estate planning while using a reverse mortgage requires careful thought and consultation with a financial advisor to ensure a secure future.

You can also read on: Flying Smart: How to Snag the Best Flight Deals on Google Flights

Choosing the Right Reverse Mortgage Lender

Researching Lenders

When considering a reverse mortgage, selecting the right lender is crucial for ensuring a positive experience. Begin your research by gathering recommendations from friends, family, or financial advisors. Utilize online reviews and ratings to gauge lenders’ reputations in the community. Look for lenders that offer:

- Clear communication and transparency

- Competitive interest rates

- Positive customer feedback

Doing thorough research can help avoid potential pitfalls and foster confidence in your lender choice.

Understanding Terms and Conditions

Before committing to a reverse mortgage, it’s imperative to grasp the terms and conditions associated with the loan. Each lender may have different requirements and fees that can significantly impact your financial situation. Here are some critical aspects to clarify:

- Interest rates: Fixed vs. variable

- Disbursement options: Lump sum, monthly payments, or line of credit

- Fees and costs: Origination fees, closing costs, and insurance premiums

By fully understanding these elements, homeowners can make informed decisions that align with their retirement goals.

Reverse Mortgage Counseling

Importance of Counseling

Before considering a reverse mortgage, it’s essential to understand the implications thoroughly. Reverse mortgage counseling provides borrowers with the knowledge they need to make informed decisions. For many seniors, entering into such financial agreements can be daunting; counseling takes the mystery out of the process. Here are some key points to consider:

- Informed Decision-Making: Counseling helps clarify the benefits and risks associated with reverse mortgages.

- Understanding Obligations: Seniors learn about ongoing responsibilities, such as maintaining property taxes and homeowners insurance.

- Exploring Alternatives: A counselor might present other financial options that could be better suited to a borrower’s needs.

Finding a HUD-Approved Counselor

To access reverse mortgage counseling, borrowers must seek out a HUD-approved counselor. This step ensures that they receive objective, accurate information about the process.

- Online Resources: A quick search on the HUD website can help find a list of approved counselors in your area.

- Local Agencies: Many community organizations offer counseling services and can guide seniors step by step.

For someone ready to explore this financial avenue, don’t hesitate to reach out to a counselor. The right guidance can make all the difference in achieving peace of mind about your financial future.

Conclusion

Summary of Benefits

In conclusion, a reverse mortgage can be a valuable financial tool for seniors seeking stability and financial freedom. Key benefits include:

- Ability to stay in your home: Seniors can remain in their cherished spaces without the burden of monthly mortgage payments.

- Tax-free income: Funds received through a reverse mortgage are not taxable, allowing for better cash flow.

- Flexible payment options: Borrowers can choose how they receive funds—lump sum, monthly payments, or a line of credit—tailoring the disbursement to their unique needs.

Final Thoughts on Retirement Planning

As seniors navigate retirement planning, it’s crucial to consider all available options. A reverse mortgage could provide the financial means to maintain their lifestyle while supporting the challenge of rising costs. However, it’s essential to discuss these strategies with a financial advisor to ensure they align with long-term goals. Engaging in thorough research and involving family members in these conversations can lead to a more informed decision.

You can also read on: The Art of Crypto Market Analysis: Techniques and Strategies Revealed